Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

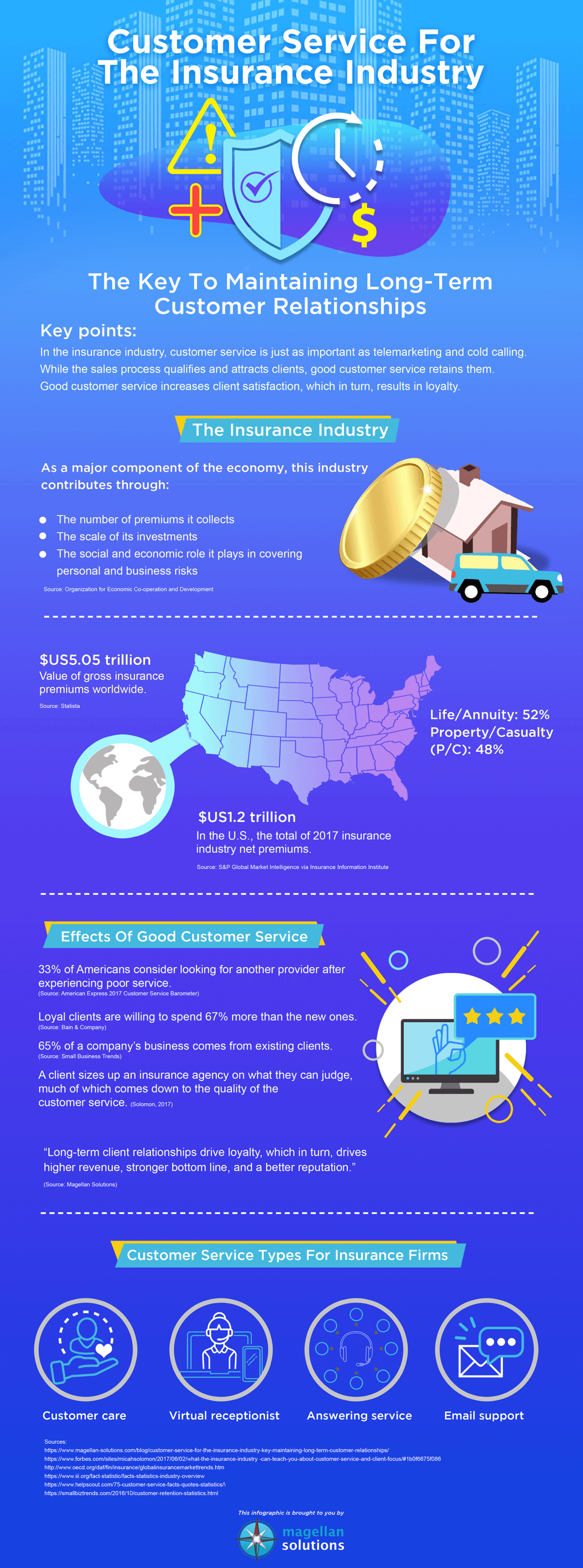

The treasure chest of any business lies not on their products or services but on the loyal consumers who love their products and/or services. This is especially true for the insurance industry that relies greatly on its customer base. To keep the business going, companies from this sector should do their best to attract many customers and retain the existing ones. Because of this, customer service for the insurance industry is really important.

Securing the future of customers

Businesses from the insurance sector offer risk management plans in the form of insurance contracts. Insurance companies give their customers and their prospects an assurance that they will be protected in case an uncertain future event happens. The common types of insurance that the majority of people know about are the following: automobile insurance, property insurance, health insurance, life insurance, burial insurance, disability insurance, and many more.

To make it work, the insured or the policyholder will pay a specific amount to the insurance company. A package is usually offered, depending on the terms agreed by both parties.

With that concept, we can see that the insurance industry is grounded on their clients. It is a people business. If the stream of new customers stopped, or when their existing clients stop their contribution, the business will go bankrupt

To prevent that from happening, customer service for the insurance industry should be delivered with utmost excellence.

Insurance companies should always keep in mind that aside from securing the future of their customers, they should also secure their present relationships with them. In exchange, the security of their business is also guaranteed.

Why is long-term customer relationship important?

Satisfied customers are the pillar of any insurance company. If they become consistently happy with the service they are provided with, they become loyal customers. These clients become engaged with the company on a deep emotional level. They have developed a sense of trust with the company. As a result, they become more willing to spend 67 percent more than the new ones.

When it comes to cost, retaining existing customers is cheaper. According to studies, companies have to spend five times more if they are to attract a new one.

Long-term clients are also the best ambassadors an insurance company could get. Because their belief with the service is already on a deep level, they are more likely to spread the word about their insurance. This is a very important aspect because many people still choose to believe in testimonials of someone they know personally.

Through these positive testimonials, the image or reputation of the company is also strengthened.

Customer service for the insurance industry

So how can insurance companies create long-term customer relationships?

Maintaining open communication is one of the most crucial aspects. They have to really listen to what their customers are saying. By letting their customers know that they are willing to guide them throughout their journey, they can gain their trust, which is the ultimate goal in building relationships. After all, these people entrusted their hard-earned money to the insurance company. Another key aspect is a timely response. This would make customers feel valued.

Customer service for the insurance industry does not only end on personal interactions with the clients. To maintain a healthy and lasting relationship, companies should make sure that they are staying true to their promise. This is another way of giving real service to customers.

Remember, long-term customer relationships drive loyalty, which in turn, drives higher revenue, stronger bottom line, and a better reputation.

Interested in getting customer service for the insurance industry? Philippine call centers can do the job.Contact us now for more details.