Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

As an insurance agency owner, you constantly seek ways to improve efficiency, cut costs, and enhance customer satisfaction. One option that’s gained traction in recent years is insurance agency customer service outsourcing. But is it the right move for your agency?

Before we debate, let’s look at the numbers. According to a 2023 report by Deloitte, 59% of insurance companies outsource at least some of their customer service functions. This represents a 12% increase from 2018, indicating a growing trend in the industry.

Insurance Processes You Can Outsource

Insurance companies can benefit from outsourcing both front-office and back-office tasks. Here are some key services that insurance BPO providers offer:

1. Claims Processing

BPO teams can handle various aspects of claims management, including:

- Receiving and logging claims

- Investigating claim details

- Collecting and reviewing evidence

- Assessing liability and damages

- Negotiating and settling claims

- Issuing payments to policyholders

These teams use specialized tools like case management software, document automation systems, and legal analytics tools to simplify the claims process.

2. Policy Administration

Outsourcing partners can manage the entire policy lifecycle:

- Onboarding new policies

- Issuing policy documents

- Collecting and managing premiums

- Handling policy changes and endorsements

- Managing policy renewals

BPO providers use policy administration systems, document management tools, and business process management software to ensure accuracy and efficiency.

3. Insurance Underwriting

BPO experts can assist with various underwriting tasks:

- Reviewing application materials

- Evaluating risk profiles

- Providing underwriting recommendations

- Handling new business and renewal underwriting

- Assessing risks and determining pricing

These professionals use advanced tools like underwriting software, data analytics, artificial intelligence, and cloud computing to improve the underwriting process.

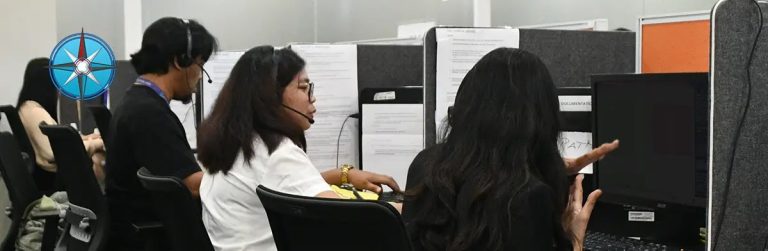

4. Customer Service

Outsourced customer service teams can:

- Handle phone calls and emails from policyholders

- Provide information about insurance products

- Process claims

- Resolve customer issues

- Educate customers about their coverage

- Upsell and cross-sell insurance products

- Maintain customer records

To enhance customer support efficiency, BPO providers use knowledge management systems, customer relationship management (CRM) software, and chatbots.

By partnering with a BPO provider, insurance companies can improve operational efficiency, reduce costs, and focus on core business activities while ensuring high-quality service delivery.

Advantages of Insurance Agency Customer Service Outsourcing

Insurance agency customer service outsourcing can help companies work better, save money, and grow by using experts and new technology.

Improved Risk Management

Outsourcing processes allow insurance companies to transfer certain operational risks to service providers, which can help reduce the company’s overall risk exposure. Insurers can focus on core business activities by delegating specific tasks to specialists while mitigating potential risks.

Enhanced Market Operations

Outsourcing providers offer state-of-the-art systems that enable the rapid development and testing of multiple functions. This agility allows insurers to be first to market with new products and establish competitive pricing. As a result, insurance companies can improve their sales and profitability in a highly competitive environment.

Increased Revenue

Outsourcing partners implement innovative tools and train specialists to manage collections and dispute operations while boosting customer satisfaction. This approach can lead to improved collections, reduced claims life cycles, and increased daily collections. Outsourcing can significantly enhance an insurer’s profitability by addressing system inefficiencies and revenue leakages.

Cost-Effective Support for Expansion

Outsourcing providers can help growing insurance companies integrate newly acquired businesses and legacy systems more efficiently. This support allows insurers to transition effectively during mergers or acquisitions without distracting internal staff from core activities. Outsourcing partners can also reduce processing costs for newly acquired blocks built on legacy systems while maintaining or improving service quality.

Access to Better Resources

Insurance support specialists typically have the manpower and technology to handle tasks like policy filing more effectively. Outsourcing allows insurers to scale their workforce easily based on need without the financial and emotional issues associated with hiring and firing internal employees. This flexibility ensures that skilled professionals always handle critical tasks, even during peak periods or staff absences.

Downsides of Insurance Agency Customer Service Outsourcing

Insurance agency customer service outsourcing can have problems with data safety, work quality, and working with people from different cultures.

Compliance Risks

The insurance industry is heavily regulated. Outsourcing customer service introduces additional complexity regarding compliance with data privacy regulations and industry-specific guidelines. Rigorous training and clear communication protocols are essential to ensure all customer interactions adhere to regulations.

Impact on Brand Storytelling

Customer service interactions are a crucial touchpoint for brand storytelling. Outsourcing can dilute your agency’s brand voice and make it challenging to weave your unique story into customer interactions. Developing a comprehensive brand communication plan and ongoing training for outsourced agents can mitigate this risk.

Potential for Ethical Lapses

Outsourcing to some regions might raise ethical concerns regarding labor practices and worker compensation. It is crucial to choose an outsourcing partner with a strong commitment to ethical sourcing and fair labor practices.

By carefully considering these uncommon advantages and disadvantages, insurance agencies can make a more informed decision about whether outsourcing customer service aligns with their goals and brand values.

Trends in Insurance Agency Customer Service Outsourcing

Insurance companies are finding new ways to get help with their work, using smart tools and fresh ideas to save money and make customers happier.

1. Quantum Computing Applications

This involves using quantum computers to solve complex insurance problems. Using advanced cryptography, Quantum computing might also optimize investment portfolios and enhance data security.

2. Biometric Authentication

This trend involves using unique physical characteristics for identity verification. Insurance agency customer service outsourcing could mean using voice recognition for customer service calls or facial recognition for processing claims. This technology enhances security and speeds up various insurance processes.

3. Gamification in Training and Customer Engagement

This trend applies game-like elements to non-game contexts. Insurance outsourcing could be used to make training more engaging for staff or to educate customers about insurance products in a fun, interactive way. It might also make risk assessment processes more engaging for customers.

4. Edge Computing in Claims Processing

This involves processing data closer to where it’s generated rather than in a centralized location. Insurance could speed up claims processing by allowing data to be analyzed closer to the source. This is particularly useful for mobile claims processing or areas with limited internet connectivity.

Upgrade Your Insurance Agency Customer Service Outsourcing: Reach Out to Industry Experts!

The first step towards transforming your agency is to schedule your free, no-obligation consultation today. Magellan Solutions skilled experts are standing by to craft a tailored solution that will improve your customer service and encourage your business forward. We can show you how to:

- Reduce your costs

- Improve your customer service

- Focus on growing your business

As our CEO Fred Chua always emphasizes, “Magellan Solutions is a generalist type of BPO company. We can handle most of the outsourcing requirements thrown our way because our approach to different clients also adjusts based on the requirements. This allows Magellan to support many clients needing to outsource.”

Let’s work together to make your agency better. Contact us now